Each FDCPA violation is a $1,000 fine that is rewarded to you.

As an informed consumer who knows your rights, it’s important to keep them honest by taking legal action against them when your rights have been violated. Suing a Debt Collector, Original Creditor, or Credit Bureau in Small Claims CourtĪs previously mentioned, the Fair Debt Collection Practices Act allows you to sue them in state or federal court and win money.

You may also consider contacting your state attorney general’s office. You can inform the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC) of any violations by submitting a complaint. If a debt collector has attempted any of the behaviors listed above with you, they have broken the law and should pay the price.

Continuing to contact a consumer after receiving “cease communication” notice. #FAIR DEBT COLLECTION PRACTICES ACT S VERIFICATION#

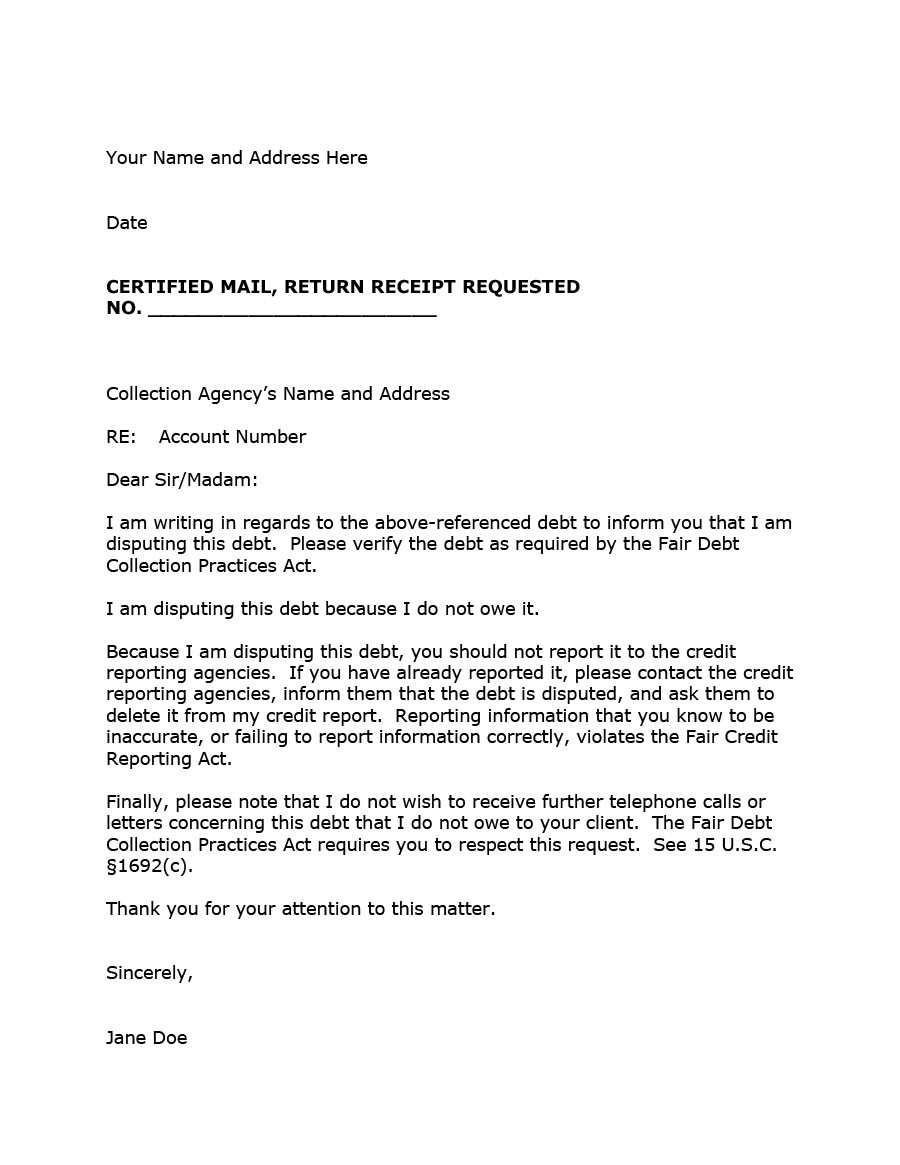

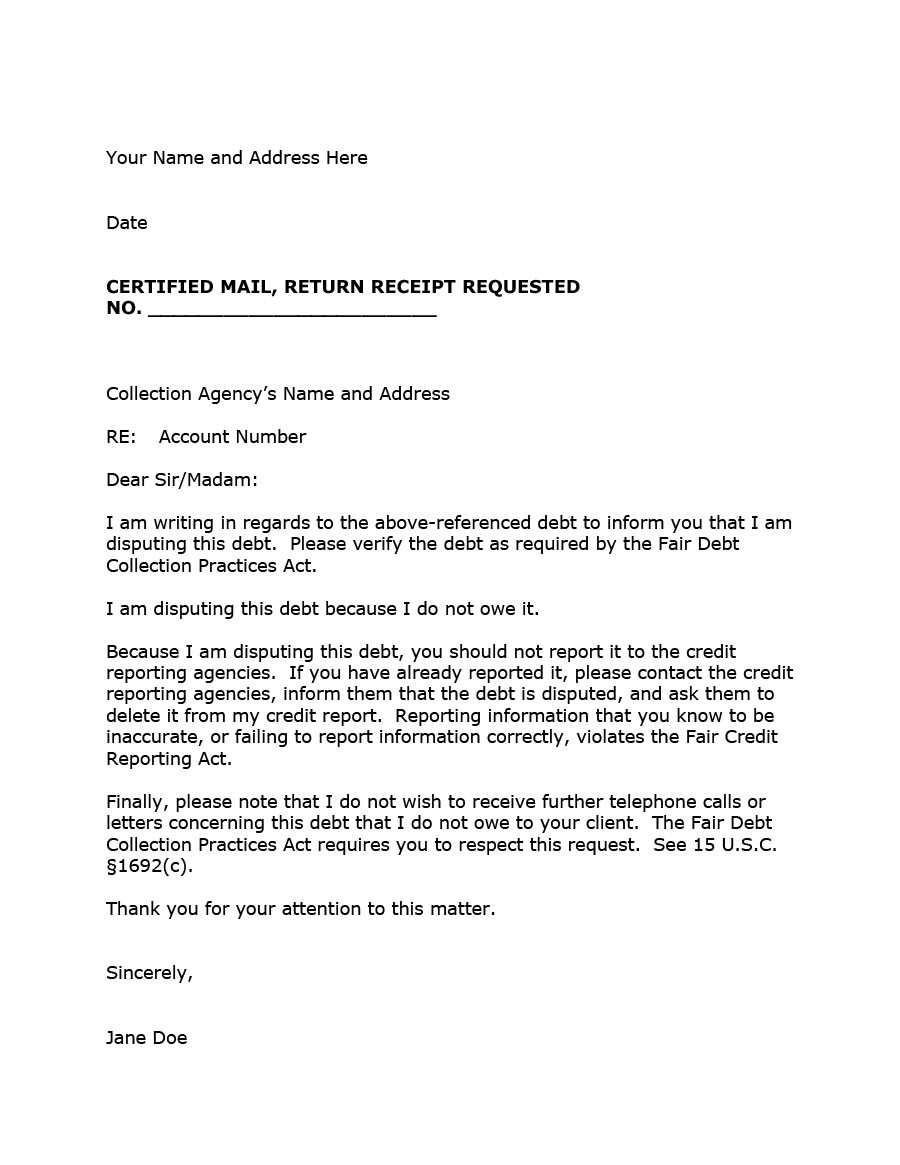

Failing to provide verification of the debt that’s being disputed. Failing to send required consumer notice. Revealing alleged debt to third parties. Impermissible calls to consumer’s place of employment. Threatening dire consequences if the consumer fails to pay. Demanding a larger payment than is permitted by law. Harassing the alleged debtor or others. The following were the primary complaints against debt collection agencies: According to the FTC’s annual report on the Fair Debt Collection Practices Act, more than 100,000 complaints were filed against debt collection agencies. They must respond to the letter before continuing collection attempts.įair Debt Collection Practices Act Complaintsĭespite the protections guaranteed by the FDCPA, debt collectors violate the law regularly. Debt collectors must not continue to try and collect debts after they receive a debt validation letter. Also, they may only contact outside sources to locate you, but they may only contact the outside source one time. Debt collectors can only share details of your debts with legal advisors and close family members such as a spouse or parent (if you are under 18). Inform outside individuals of the debt you owe. Making insults or threats of physical violence over the phone violates the FDCPA. and 9 p.m., or at other times when they know it would be inconvenient for you. According to the law, creditors cannot call you between 8 a.m. Call repeatedly at all times of the day. Some debt collectors try to tack on additional fees that are not detailed in your original lending agreement, which is illegal. Attempt to collect more than the debt you owe. A third-party debt collector may not do any of the following while attempting to collect a debt: The Fair Debt Collection Practices Act (FDCPA) outlines what debt collection agencies can and cannot do. Fair Debt Collection Practices Act Violations The FDCPA also gives you rights concerning when and how frequently a debt collection agency may contact you and what they are permitted to say when they’re talking to you. This letter puts the burden of proof on your creditors to show you the details about any debt you may owe. Any time you are contacted about a debt you aren’t certain you owe, you may send a debt validation letter to the debt collector.

One of the main tools given to consumers in the FDCPA is the right to debt validation. Rights Guaranteed to Consumers Under the Fair Debt Collection Practices Act It is also what allows you to sue them in small claims court for violating your consumer rights.

The Fair Debt Collection Practices Act is your best weapon to get debt collectors out of your life and collection accounts removed from your credit report. The FDCPA allows you to fight back against them. The FDCPA is what you will be using to protect you against third-party debt collectors and their unfair practices and illegal debt collection tactics. If you have had debt collectors hounding you over a debt, it is imperative that you know what your rights are as outlined in the FDCPA. The Fair Debt Collection Practices Act (FDCPA) is a law originally passed in 1978 to protect consumers and regulate the tactics used by debt collectors.

0 kommentar(er)

0 kommentar(er)